Understanding the Costs of Medical Bills and How to Lower Them

Medical bills are often problematic for two main reasons: (1) the prices charged are unreasonably high, and (2) there was no clear, mutual agreement between the provider and patient about what would be charged and what the patient would pay.These two issues—egregious pricing and lack of informed consent—are at the root of most problem medical bills.

That’s wherePatient Fairnesscomes in. We help patients dispute unfair medical bills with professional tools, strategic insights, and expert guidance—all for a low flat fee. If you're facing a medical bill that seems unreasonable, this guide will help you understand why it's so expensive—and how you can dispute it effectively.

Why Medical Bills Include Excessive Charges

Most problem medical bills come down to one core issue:the prices are simply too high. Hospitals and other medical providers often charge many times more than it actually costs them to deliver the service—and patients are rarely told what these charges will be in advance.

Inflated Pricing

Hospitals set their own internal prices using what’s called a chargemaster. According to data hospitals report to the Centers for Medicare & Medicaid Services, theaverage hospital charges about 4 times its costs—and some hospitals charge10 times or more. That means a service that costs the hospital $1,000 might be billed at an average of $4,000 but can exceed $10,000.

No Advance Agreement on Charges

In most problem medical bills,there was no shared understanding between the patient and providerabout what the services would cost. This lack of disclosure and agreement means the patient never truly consented to the prices being charged. In most areas of consumer law, this would invalidate the transaction—but in medical billing, patients often face these charges without any prior discussion or consent.

Surprise Billing Is a Pricing Problem

Many surprise bills result from unclear or a lack of communication about who is providing the service and how it will be billed. A patient may receive care from a provider they didn’t choose or receive separate bills from facilities or professionals they didn’t know about. Whether you are insured or not, the real issue is the same:the prices were never agreed to, and they often exceed reasonable benchmarks by several times.

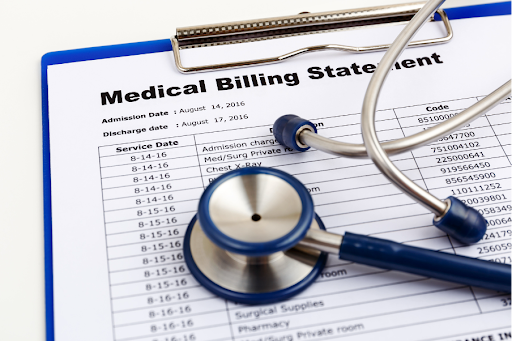

Understanding the Medical Bill Price Review

- Medicare Price– This is the amount a provider would receive under Medicare. Since most providers accept Medicare prices as full payment, it’s a widely used and credible benchmark. If your bill is several times higher than Medicare rates, you may have grounds to dispute it.

- Hospital Profit/Cost Analysis– For hospital bills, we estimate what it cost the provider to deliver the service. If you're being charged 5–10 times the cost, that could signal excessive profit. These insights help you decide what you think is fair to pay.

Negotiating Lower Prices & Payment Plans

Even if your bill is technically “accurate,” that doesn’t mean you have to pay the full amount.

Know and Stand Up for Your Rights

The Fastest Way to Reduce an Unfair Bill: Patient Fairness

Step 1: Examine the Bill & Identify Concerns

Upload documents like your medical bill and insurance information, and complete the free Problem Medical Bill Assessment to share details about the bill, the services received, and insurance information (if applicable). We analyze this information to identify potential concerns on which to base a dispute.

Step 2: Dispute the Bill

Based on your assessment, we create a custom Letter of Dispute that outlines your concerns and formally puts the bill under dispute. The letter requests a response within 30 days and asks for more detailed billing information. Patient Fairness sends the letter for you and tracks the provider’s response. If no reply is received, we send a follow-up letter.

Step 3: Pursue Resolution

All of this is available for a flat fee starting at just$49—never a percentage of your savings and no surprise charges.

Empowering You to Take Action

Medical billing is complicated, but you don’t have to face it alone. With Patient Fairness, you get:

- Expert tools and guidance to dispute unfair bills

- A simple, low-cost way to fight back

- Price comparisons to help you understand charges

- Crafting powerful letters of dispute to demand fairness

- Support throughout the entire dispute process